1. Advisory

Mergers and acquisitions - the driver behind these transactions is the business logic that 1+1 equals 3 instead of 2. The basic principle is to create, through synergies, the value for company owners that exceeds mere sum of individual companies’ worth. However, in real life there are numerous business combinations, actually representing a certain number of variations of mergers and acquisitions. With its expertise and experience, our team is able to boost your chances of success in the realization of certain transaction under given circumstances.

Due diligence - is the process of business verification, usually during the process of sale. Financial statements often don’t offer a realistic picture of a company. There might be, for instance, some hidden reserves in the company that may increase its market value, or perhaps some assets shown in the financial statements that have a lower value than the one indicated there or maybe don’t exist at all.

Over many years of experience in international auditing companies (The Big Four), our experts have performed a wide range of in-depth assessments of companies in various industries. The in-depth analysis services offered by us cover the following:

- checking financial statements and accounting records of the target company;

- search for key success factors affecting the purchase decision;

- support and counselling during negotiations about the purchase of a company.

Spin off/disinvestment - is the sale of certain business parts of the company that has become more widely accepted growth strategy than diversification. The strategy of every company should be a focus on core business. Divesting non-core business provides your management focus on creating value for shareholders in the core business. Disinvestment creates significant cash flows in the company that can be used for additional investments in core business.

Recapitalization - in case you have development projects that will increase the value of the company but they are not able to finance through loans, we will help you in the process of finding investors.

We will be glad to help you structure, prepare, implement and close the project, to identify appropriate investors, to organize and co-ordinate the due diligence, to prepare the management for the meetings with investors, to counsel you during negotiations and finally to successfully conclude the transaction.

Management Buyout (MBO) - the transaction and financing of MBO is very important and often quite demanding, too. Our experience will help you purchase the assets and the business you used to manage.

Leveraged Buyout (LBO) - if you want to purchase another company, we will help you get required loans in order to cover the acquisition. The purpose of LBO is to enable companies to make large acquisitions without involving large amounts of own capital in the transaction.

Employee stock ownership plan (ESOP) - you have decided to offer your employees the possibility of becoming shareholders without acquisition fees. In that case, the ESOP shares become part of your employees’ work compensation. The shares allocated to your employees can be held in a joint trust fund until retirement or until the moment they leave the company.

Privatization - you want to start the process of transferring the ownership over state assets and companies to private investors. The two best known models of achieving that, for which we offer consultancy services, are the following:

- transfer or sale of stocks/business shares in state companies to the public and

- contracting out

2. Restructuring

Refers to significant changes at the level of company management, finances, organizational structure, business processes, in-house capacities, but also motivation of employees.

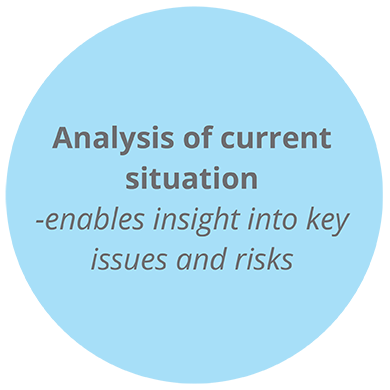

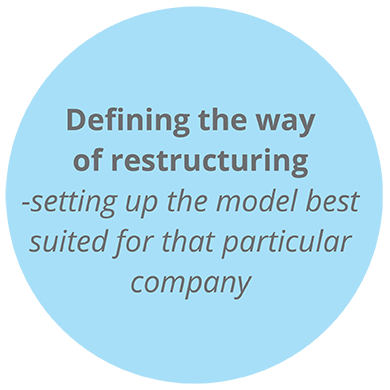

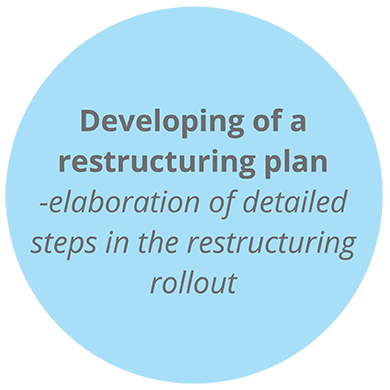

Restructuring is most often carried out through four key phases:

3. Project finance

Involves financing of project development for the projects in which creditors expect repayment of loans from the revenues generated by the project, using project assets as collateral. Project finance is usually applied in capital intensive industries, when creditworthiness of project leaders is insufficient for traditional forms of financing or if they are not willing to assume the associated risks and loan repayment obligations. In the project financing model, the project risks are distributed among several partners, thus being reduced to the level acceptable for each individual partner included in such an arrangement.

The technique of project finance is applicable in the infrastructure project financing, as these are generally long-term, complex and financially demanding projects that can be structured so as to assure their market feasibility and sustainability.

6. Other services

Part – time CFO - this service offers you a CFO expert who will collaborate closely with your staff in matters related to financial strategy and analysis.

We join our efforts with you in the planning and rollout of initiatives created in order to reduce your costs, to boost your growth and profits.

Special services acquired by renting a CFO :

- Monitoring of finance and accounting function in a company, including monitoring of staff in financial departments

- Evaluation and improvement of internal control systems in order to reduce the risk of fraud and embezzlement

- Offering guidelines in the area of financial risks management and overall strategic planning

- Representation of company towards creditors, investors and other external sources of financing

Part - time Controller - if you have decided to introduce or if you need the function/service of controlling in your company, you can rent our expert in the project of controlling function implementation or for particular tasks within the scope of an assigned project:

- Cost planning for cost centres

- Contributions calculation

- Corporate planning

- Creation of special reports and monitoring/early warning systems

- Budgeting and beyond budgeting

- Drawing up of balanced scorecards

- Drawing up of dashboards with KPIs